2025

Final Results

05 September 2024

Fusion Antibodies plc (AIM: FAB), specialists in pre-clinical antibody discovery, engineering and supply for both therapeutic drug and diagnostic applications, announces its final results for the year ended 31 March 2024.

DownloadTo view a full version of the results in |

Commercial and operational highlights

- Audited revenues for FY24 of £1.14m (FY23: £2.90m)

- Fundraise announced in February 2024, raising £1.37m (before expenses) for general working capital and investment into commercial activities

- Significant increase in sales pipeline opportunities during the second half of FY24, with an orderbook at 31 March 2024 of £0.75m, representing 65 per cent. of total FY24 audited revenues

- Cash position as at 31 March 2024 of £1.2m (31 March 2023: £0.2m)

Post period end highlights

- Increased activity in the second half of FY24, including:

- the entry into a collaboration agreement with the National Cancer Institute for the use of OptiMAL®;

- a first purchase order received under a master services agreement (“MSA”) with a leading diagnostics company; and

- a follow-on project received with a US based biotechnology client.

Adrian Kinkaid, CEO of Fusion Antibodies commented: “We have had a largely challenging FY24, with the industry experiencing significant headwinds especially in the venture capital funded biotech sector. A number of clients had consequently delayed initiating their projects with us as a result of this. Having said that, we are starting to see an improvement and we did complete a successful fundraise for further investment into the business in February this year.

“Since the year end, we have increased commercial activity and had more success, with a number of new agreements signed. The OptiMAL® programme is continuing to go well, and we are seeing more traction in the field as the year progresses.

“We remain positive about the future of the Company and are, as always, thankful to our dedicated shareholders for their constant support. As we continue to meet our objectives on our strategy toward breakeven and profitability, we have no plans to raise cash through an equity placement.”

Investor briefing

Fusion will host an online live presentation open to all investors on Thursday, 12 September 2024 at 3pm BST, delivered by Dr Adrian Kinkaid, CEO and Stephen Smyth, CFO. The Company is committed to providing an opportunity for all existing and potential investors to hear directly from management on its results whilst additionally providing an update on the business and current trading.

The presentation will be hosted through the digital platform Investor Meet Company.

Investors can sign up to Investor Meet Company for free and add to meet Fusion Antibodies plc via the following link: https://www.investormeetcompany.com/fusion-antibodies-plc/register-investor

For those investors who have already registered and added to meet the Company, they will automatically be invited. Questions can be submitted pre-event via your IMC dashboard or in real time during the presentation, via the "Ask a Question" function. Whilst the Company may not be in a position to answer every question it receives, it will address the most prominent within the confines of information already disclosed to the market through regulatory notifications. A recording of the presentation, a PDF of the slides used, and responses to the Q&A session will be available on the Investor Meet Company platform afterwards.

Enquiries:

| Fusion Antibodies plc | www.fusionantibodies.com | |

| Adrian Kinkaid, Chief Executive Officer Stephen Smyth, Chief Financial Officer | Via Walbrook PR | |

| Fusion Antibodies interactive investor hub | https://investorhub.fusionantibodies.com/ | |

| Allenby Capital Limited | Tel: +44 (0) 20 3328 5656 | |

| James Reeve/Vivek Bhardwaj (Corporate Finance) Tony Quirke/Joscelin Pinnington (Sales and Corporate Broking) | ||

| Shard Capital Partners LLP | ||

| Damon Heath (Joint Broker) | Tel: +44 (0) 207 186 9952 | |

| Walbrook PR | Tel: +44 (0)20 7933 8780 or [email protected] | |

| Anna Dunphy | Mob: +44 (0)7876 741 001 | |

About Fusion Antibodies plc

Fusion is a Belfast based contract research organisation ("CRO") providing a range of antibody engineering services for the development of antibodies for both therapeutic drug and diagnostic applications.

The Company's ordinary shares were admitted to trading on AIM on 18 December 2017. Fusion provides a broad range of services in antibody generation, development, production, characterisation and optimisation. These services include antigen expression, antibody production, purification and sequencing, antibody humanisation using Fusion's proprietary CDRx TM platform and the production of antibody generating stable cell lines to provide material for use in clinical trials. Since 2012, the Company has successfully sequenced and expressed over 250 antibodies and successfully completed over 200 humanisation projects and has an international, blue-chip client base, which has included eight of the top 10 global pharmaceutical companies by revenue.

The Company was established in 2001 as a spin out from Queen's University Belfast. The Company's mission is to enable pharmaceutical and diagnostic companies to develop innovative products in a timely and cost-effective manner for the benefit of the global healthcare industry. Fusion Antibodies provides a broad range of services in antibody generation, development, production, characterisation and optimisation.

Fusion Antibodies growth strategy is based on combining the latest technological advances with cutting edge science to deliver new platforms that will enable Pharma and Biotech companies get to the clinic faster, with the optimal drug candidate and ultimately speed up the drug development process.

The global monoclonal antibody therapeutics market was valued at $186 billion in 2021 and is forecast to surpass $445 billion in 2028, an increase at a CAGR of 13.2 per cent. for the period 2022 to 2028. Approximately 150 monoclonal antibody therapies are approved and marketed globally as of June 2022 with the top four antibody drugs each having sales of more than $3 bn in 2021.

Chairman’s Statement

The financial year ended 31 March 2024 (“FY24”) started the way the previous financial year had ended, in that the markets in which we operate remained muted, and it was commercially challenging for the Company. However, this challenge was met head on by the board of directors of the Company (the “Board” or the “Directors”), and in particular, through determination and a belief that Fusion has world class skills and expertise to create value for our shareholders, the turnaround process began. In FY24, costs were cut, headcount reduced, Board salaries deferred and a new strategy was developed. With venture capital and other investments for our customers’ early-stage human therapeutic pipelines still slow, creative solutions and antibody related new market opportunities were explored. Fusion responded both by introducing our existing services into new markets as well as introducing new services into our current markets.

New markets

Antibodies play an important part in most of our lives at some point. Obviously internally your immune system is there to combat disease and keep you healthy. But antibodies are used in many different healthcare related applications, and Fusion’s skills and expertise are applicable to all of them.

Human antibody therapeutics was our sole focus and will still be the main source of revenue in the near term but expanding into the smaller but growing veterinary medicine (VetMed) therapeutics market is an exciting new opportunity. The 30-year gap between the development of antibodies for humans and those for animals is partly because while some other human medications can be easily adopted to use in animals, antibody therapy is species specific. However, the genetic differences between species is now better understood and, in the same way as we gained a leading position in humanisation, Fusion has the capability for producing dog and cat specific antibodies, through processes known as caninisation and felinisation. There is a growing need for these therapies in veterinary medicine. For example, in the USA alone there are 6 million cases of cancer1 diagnosed each year in dogs, with a similar number in cats, and one in four American dogs is diagnosed with some form of arthritis1. In addition, allergies, dermatological conditions, renal diseases, cardiac diseases, and cancer are five key disease categories for research into new animal specific antibody therapies2.

The global monoclonal antibodies in veterinary health market size was estimated at USD 700m million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.1% from 2023 to 20303. Amongst other developments, in 2016, the USDA3 approved a monoclonal antibody to treat allergic dermatitis and atopic dermatitis in dogs and, in January 2022, the FDA granted its first approval for an antibody for animals to control pain associated with osteoarthritis in cats2.

We believe that this new market represents a strong opportunity in a strongly growing sector where most of our current services, such as OptiPhageTM, Rational Affinity Maturation Platform (“RAMP”), affinity maturation, transient expression and cell line development (“CLD”) are applicable.

1 Antibody Therapeutics - PetMedix

2 Monoclonal antibodies show promise as new therapy for veterinary patients | American Veterinary Medical Association (avma.org)

3 The U.S. Department of Agriculture (USDA) approves antibodies that target the immune system, while the FDA approves antibodies that have other targets in VetMed

4 Monoclonal Antibodies In Veterinary Health Market Report, 2030 (grandviewresearch.com)

At some point in our lives, most of us will have a blood or urine sample that is sent off to a laboratory to be tested and the test will involve antibodies in one form or another. Over the counter pregnancy tests are antibody based and we are now all familiar with the lateral flow tests for Covid-19, with the red coloured lines that appear being antibody driven. With the diagnostic market becoming more competitive, the quality, specificity and reliability of the antibody is key to the success of that test. Diagnostic companies from small to large are starting to look at ways of improving their tests through the manipulation of their antibodies to which the skills that Fusion have developed throughout the years are applicable. In addition to improving the antibody, diagnostic companies are also looking to improve continuity of supply as many of the tests will be based on polyclonal antibodies (antibodies taken directly from blood as opposed to a cell culture) which have a finite supply. While not simple, the possibility to convert these polyclonal antibodies to a secure cell structure-based supply exists, presenting Fusion with a further market opportunity. Additionally, many antibodies used in diagnostics and therapeutics start their life in pure research laboratories and companies that supply these products globally represent a further adjacent market for Fusion to sell into.

The Board of Fusion believe that this diversification strategy into the adjacent markets of VetMed, diagnostics, and research, together with the recovering economic climate, provides us with confidence for growth in the current year and the prospects for the business in the future.

Business performance

The poor global market conditions seen at the end of the financial year ended 31 March 2023 (“FY23”) continued into FY24. FY24 showed a significant downturn in revenue from the previous year at £1.14m (FY23: £2.9m). The headwinds of inflation, higher interest rates, weak global growth and continued global political instability have kept the global markets relatively quiet throughout 2023 resulting in weak market investment conditions for new drug discovery and development programs, particularly in SME’s and small earlier stage companies, which represented our primary customer type during the first half of the financial year and directly impacted the Company’s revenues for the year. Most notably was a significant downturn in venture capital (“VC”) investment into biotechnology companies, including therapeutic antibody development programmes. As an example, in the USA VC Life Healthcare and Life Sciences secured US$15.2 billion in fund closures in 2023, down 52% from a high of US$28.9 billion in 20215.

Recognising the economic challenges at the beginning of the financial year, the Company took decisive action to re-structure the business and significantly cut the cost base and implemented circa. £1.6m in restructuring savings, including a significant reduction in headcount. Although business conditions are improving, the Board will continue to closely monitor the Company’s cost base and seek to identify additional cost savings over time. Alongside the restructuring, a new commercial strategy was implemented, targeting the adjacent antibody-based Diagnostic, Veterinary Medicine and Research Antibody markets, with this diversification opening up more sales opportunities as well as making the sales pipeline more resilient with less exposure to individual sectors.

Whilst controlling costs tightly, we still believe that to maintain our scientific cutting edge and to compete in the global marketplace, we need to stay at the front of technology. We continue to invest in R&D, and particularly the OptiMAL® library project, with investment in R&D of £0.3m for FY24 (FY23: £0.8m). The downturn in revenues, together with the restructuring savings, generated a loss for FY24 of £2.3m (FY23: loss £2.9m). It is worth noting that whilst the Company continues to retain an interest of longer-term future success milestone or royalty payments in many of our client projects, there were no such payments in FY24.

The Board would like to thank our shareholders for their continued support and confidence in the Company and in the growth opportunity in front of us. In particular in supporting us through two rounds of funding in FY24, the first of which was to supply working capital to allow us to re-structure the Company and develop a new more diversified strategy. During H1 FY24, the pipeline grew significantly as we entered into the adjacent markets of Diagnostics, VetMed and research antibodies with the second round supporting the further implementation of the strategy and in particular the expansion of the commercial team.

5 Pitchbook’s Healthcare Fund Performance Update, as reported by Tracy Alper from Marks Sattin.

Specifically, in June 2023 the Company successfully completed a £1.67m (before expenses) fundraise through the placing of new ordinary shares of 4p each in the capital of the Company (“Ordinary Share”) at a price of 5 pence per new Ordinary Share (the "Issue Price"), to provide additional working capital. £1.56 million was raised through a placing, £0.14m through a subscription by certain of the directors of the Company and their closely associated persons (as defined in UK MAR) and £0.11m through a Retail Offer on the REX Platform, which resulted in the issue of a total of 33,438,768 new Ordinary Shares. The Issue Price represented a discount of approximately 84 per cent. to the closing mid-market price of an Ordinary Share on 18 May 2023.

With a new commercial strategy in place, and a strengthened pipeline, the Company successfully raised an additional £1,375,000 (before expenses) in March 2024 through a placing of 34,375,000 new Ordinary shares at a price of 4 pence. In this regard, I would like to thank our shareholders, both new and old, who supported this round, in what was a challenging economic environment. 2024 has so far been one of the quietest years for investment on AIM since 2002 and yet the issue price of the second placing was at only a small discount (~ 5.88%) to the closing mid-market price of an Ordinary Share in the Company on 13 February 2024.

Allenby Capital Limited (“Allenby Capital”) acted as broker in connection with the placing, with Shard Capital Partners LLP acting as sub-placing agent to Allenby Capital and following the placing the Company appointed Shard as joint broker to Fusion. We look forward to continuing to work with both brokers as we continue our recovery journey.

New Services

The antibody drug discovery industry and indeed other markets are gradually moving away from the use of antibodies, something that as a Company we recognise and support. Whilst animals can still be used on occasions, our R&D and new service offerings are very much aligned to the ‘Three Rs’ principle: Replacement, Reduction and Refinement*. This is the one of the competitive edges that we offer utilising our core discovery engines, OptiMAL®, OptiPhageTM, and AI/ML-AbTM. The first two are cell-based systems, while the latter is a method of designing panels of antibodies in-silico, using software algorithms. These discovery engines all work as the beginning of a customer’s journey with Fusion, with the potential to move onto the rest of our services all the way through to CLD, where the final antibody of choice is ready to be transferred externally into the production stage.

* Three Rs principle

- Replacement refers to methods which avoid or replace the use of animals

- Reduction refers to any strategy that will result in fewer animals being used

- Refinement refers to the modification of husbandry or procedures to enhance the welfare of an animal used in science

OptiMAL® is our cell-based mammalian display technology screening library in development for the direct identification of intact fully human antibodies against biomarkers and other targets of interest. It will be very much positioned as a discovery engine for human therapeutic antibodies and when fully optimised should reduce the time required to identify a target specific antibody or panel of antibodies and simplify the process of reaching that goal. The Company signed a collaboration agreement with the National Cancer Institute (“NCI”) for access to OptiMAL® over a two-year period in the discovery of novel antibodies against targets selected by NCI, which is the first time the library has been in external hands for independent validation.

Whereas OptiMAL® expresses whole antibodies, our new OptiPhageTM library is a phage display based version where smaller antibody fragments, the antibody’s specific binding components, are expressed and can be screened, at which point the DNA sequences of these fragments can be used to produce a full antibody for downstream development and further optimisation. It may also be the platform of choice for those wanting antibody fragments as their end-product. As a new service available since March 2024, we believe that the ability to provide OptiPhageTM at a lower price point allows the Company to protect the premium pricing of the OptiMAL® programme and to open it up to other markets who may have greater budgetary constraints. Our novel DNA library of antibody sequences from OptiMAL® can be used as the input design, as can other inputs for non-human applications.

In conjunction with our partners, the AI/ML-AbTM platforms provide a method of designing panels of antibodies in-silico, with the AI/ML-AbTM algorithms typically producing small libraries of sequences which are an excellent match with our Mammalian Display platform, which can transform these designs into real protein molecules for screening and final selection. While customer uptake to date has been slow, we believe that this remains an important part of our broad mix of discovery services that we offer which gives the client the choice to select which one suits them the best from their timescales, development plans and budgets.

Board and Employees

August 2023 saw the appointment of Stephen Smyth as our interim Chief Financial Officer (CFO) and Company Secretary. Stephen has over 25 years’ experience working in audit & accounting, finance, and operations management within both the public accounting and commercial sectors and we are delighted that he could join us. In addition, we have outsourced some other financial management accounting activities enabling the Company to streamline its financial position, following which the Company intends to identify a more permanent solution.

Prior to this we announced that Mr James Fair, our former CFO, was stepping down from the Board and that we would like to thank Mr James Fair for his significant contribution to the Company over the past 14 years and wish him well in his future endeavours. We are also grateful to Ms Frances Johnston who temporarily stepped in as the Company Secretary until Stephen Smyth’s appointment.

One further change to the Board during the financial year was in relation to Sonya Ferguson, who stepped down in September 2023 as a Non-executive Director to move into another business opportunity. Sonya was with the Company for seven years and was the Chair of the Company’s Remuneration Committee. On behalf of the Board, I would like to thank her for all that she had done for the Company, for her valuable insights and contributions and her balanced views. We wish her well in her new venture.

During the first half of FY24, the Executive team had to make some decisive and tough decisions as part of the restructuring process, something for which the Board is very grateful. In this respect, a big thank you to all the staff who stuck with us through the turbulent times and worked in the difficult transitionary environment with professionalism and integrity and their strength and belief in the Company has allowed us to ride the storm and to turn the Company around. With a significantly reduced headcount, staff have received extensive cross training to ensure that the Company can still offer its full range of services. A true team effort.

As part of their commitment and belief in the Company, in order to minimise the outgoing costs until the Company had secured the funds from the second fundraise in March 2024, the executive directors, Adrian Kinkaid and Richard Buick, deferred 20% of their salary and then only took half as salary with the remainder in new Ordinary Shares at the issue price of 4 pence. Likewise, the Company’s non-executive directors deferred their fees for 10 months and were subsequently remunerated part in salary and part in new Ordinary Shares, a structure that will continue until the end of FY25.

Corporate governance

The long-term success of the business and delivery on strategy depends on good corporate governance. The Company complies with the Quoted Companies Alliance Corporate Governance Code as explained more fully in the Governance Report.

Post year end and outlook

As reported, the full year results for FY24 are lower than anticipated, but the restructuring, fundraising and market diversification strategy has given the Company a new foundation on which to grow. Trading has improved throughout the year with February and March 2024 being the Company’s highest earning months of FY24. There has been a significant increase in sales pipeline opportunities, which are now around three times greater than they were at the beginning of the financial year, and include new Diagnostic, VetMed and Research potential customers. In addition to the increased sale pipeline our R&D OptiMAL® library project hit a major milestone in H2 FY24 and signed a collaboration agreement with the NCI for the use of OptiMAL® in the discovery of novel antibodies against targets selected by NCI post year.

There was an increased commercial activity and momentum in the fourth quarter of FY24 and into the beginning of FY25, including:

- receipt of a first purchase order under a master services agreement (“MSA”) with a leading diagnostics company in FY24 - with further orders having been received in FY25 under the MSA from the customer;

- securing an estimated $650,000 follow-on project under a collaborative research and development agreement with a US based biotechnology company that Fusion started working with in 2021; and

- A commercial contract to develop a bespoke OptiPhageTM library for a non-human antibody species with a leading global provider of antibodies for use in research and diagnostics.

In July 2024, we announced that our unaudited revenues for the first quarter (“Q1”) of FY25 was c. £522k (Q1 FY24: £241k and FY24: £1.14m) with a strong sales pipeline. The order book includes a number of multi-stage projects for its clients and, subject to these projects progressing in line with expectations, revenue is expected to be recognised for all projects in the current order book in the current financial year.

The Company continues to carefully control its cash and, as set out at the time of the fundraise in February 2024. Based on updated internal estimates the Company now has a cash runway into the second half of FY26. The Company continues to seek to achieve cash neutrality during that timeframe.

The Board of Fusion believe that this momentum and developments provide strong evidence that the Company’s diversification strategy, together with the recovering economic climate, provide confidence for growth in FY25.

Simon Douglas

Chairman

4 September 2024

CEO’s report and operations review

Fusion emerges from a difficult and challenging FY24 as a much improved, more capable and more efficient business with great prospects for growth in revenues and value creation courtesy of our proprietary technologies.

During FY24, the Company was presented with several commercial and financial challenges which we met robustly and with determination. Most notable was a continued downturn in the global market. Through 2023, many of our clients experienced challenges in securing investment to support their research and development activities. This was especially so for the smaller biotechnology companies reliant on venture capital funding for novel therapeutic discovery projects. This represented a significant proportion of our pre-existing client base and, with their delayed plans for early-stage development projects had significant knock-on effects on revenues for the Company. Remedial action was speedily taken and effectively realised. A defined programme of cost saving measures was put in place at the start of FY24 which included significant restructuring, reducing various costs including a 38% reduction in headcount. At the same time, plans to extend and diversify the client base were implemented to address the adjacent and substantial Diagnostic, Veterinary Medicine and Research Antibody markets. The positioning of the Company’s offerings were adjusted to improve efficiency and have more impact with this diversification making the sales pipeline more resilient with less exposure to individual sectors and increasing the overall addressable market size.

In particular, we increased our efforts in targeting the diagnostics industry, which has been enjoying an unprecedented level of awareness especially through the Covid-19 related antibody enabled lateral flow devices and related cash inflows. In the latter part of the year this resulted in several contract wins for Fusion with both small and large diagnostics organizations, the latter exemplified by the Master Service Agreement announced on 14th February 2024. The process of discovering and developing antibodies for diagnostics applications is very similar to that for therapeutics and fits well with our preferred business model whereby we can take responsibility for the process from as early as antigen design for the nominated target through to supply of antibodies. As previously stated for therapeutics, this fully integrated approach allows us to derive more revenue per project by assuming more responsibility for more of the research programme. It also positions the business to better exploit our emerging platforms for antibody discovery, our “Discovery Engines”, which we continue to develop making best use of the different component technologies from the OptiMAL® research project.

Similarly for the Veterinary Medicine market, which has an estimated global value of $46.5bn and a forecasted compound annual growth rate of 8.3% from 2024 to 2030 [Veterinary Medicine Market Size, Share, Growth Report 2030 (grandviewresearch.com)], the Company identified several potential partners and projects. The requirement for making antibodies suitable for use in companion animals such as dogs and cats known as caninisation and felinisation respectively is very similar in nature to the humanisation processes for which Fusion is an established world leader. The Company is therefore continuing to exploit this growth market and increasing its sales and marketing efforts in the area building awareness with this specialist client base.

The initial objective for the research project was to create OptiMAL®, a groundbreaking and industry leading platform for the discovery of human antibodies through a highly diverse library of DNA sequences expressed as fully intact antibodies, or IgG molecules, expressed on the surface of mammalian cells. This has now been largely achieved and whilst in beta-testing stage we were delighted to announce in November 2023, a 2-year agreement with the NCI, part of the National Institutes of Health in the USA, to validate OptiMAL® screening against a small number of targets in the NCI’s own laboratories. This will validate not only the technology but also the ability to transfer it to other organizations and so lay the path for potential licensing agreements with, for example, big pharma and major biotechnology companies. Furthermore, the significant prestige and kudos associated with NCI make them an ideal partner for this process and an organization with which we seek to strengthen our connections.

Two further discovery platforms: OptiphageTM and AI/ML-AbTM have also been launched off the back of the OptiMAL® research programme. OptiphageTM utilises a library based on the same principles as OptiMAL®, but in a more industry standard phage-display format, whilst the Mammalian Display element of OptiMAL® can be combined with algorithms for the de novo design of novel antibodies from various artificial intelligence (AI) and Machine Learning (ML) technologies which continue to generate interest and excitement in the field. We were very pleased to launch AI/ML-AbTM in August 2023 with an almost immediate contract win. OptiphageTM also attracted significant client attention even before launching in April 2024. This was achieved through a contract with an early adopter seeking a non-animal-based solution to generating non-human antibodies primarily for research and diagnostic applications as announced on 15th April 2024. The availability of these diverse and complementary proprietary “Discovery Engines”, which can be deployed individually or in concert, also enables us to provide a de-risked approach to antibody discovery further benefiting our clients and strengthening Fusion’s position as the partner of choice.

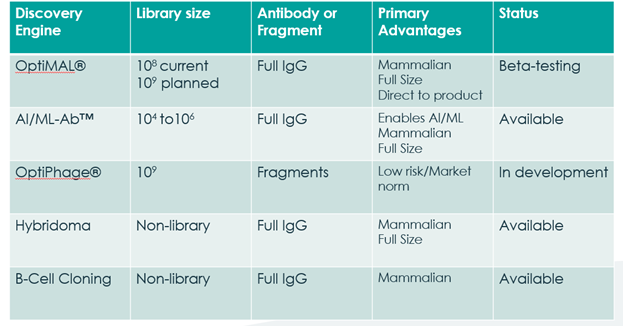

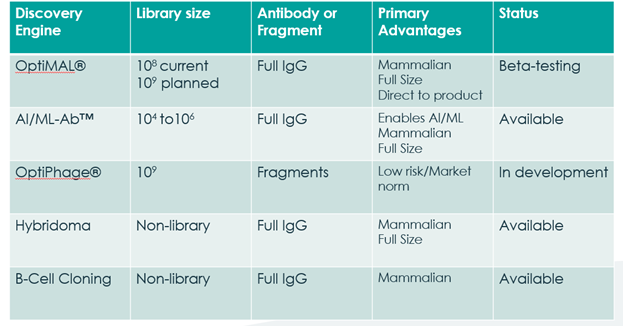

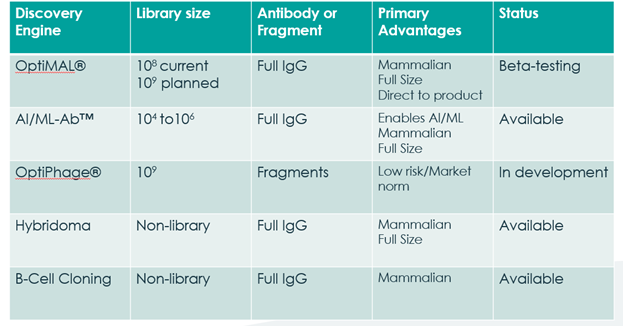

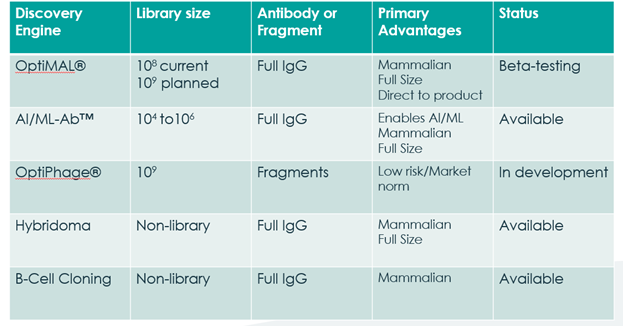

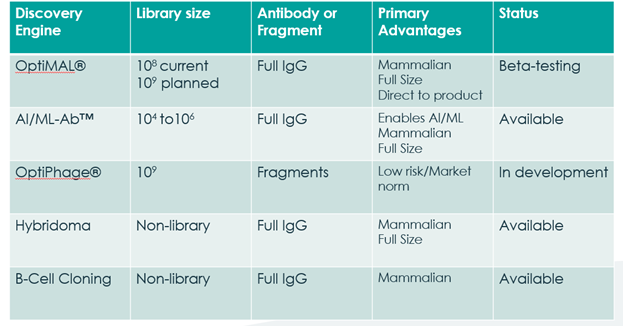

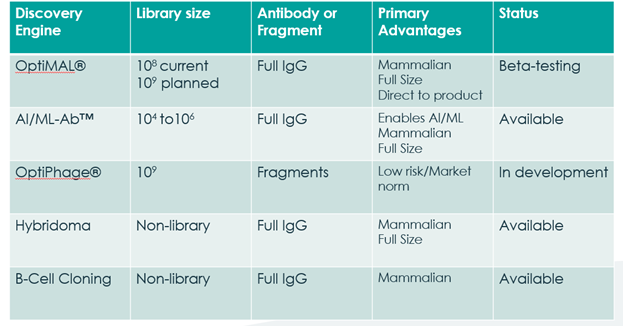

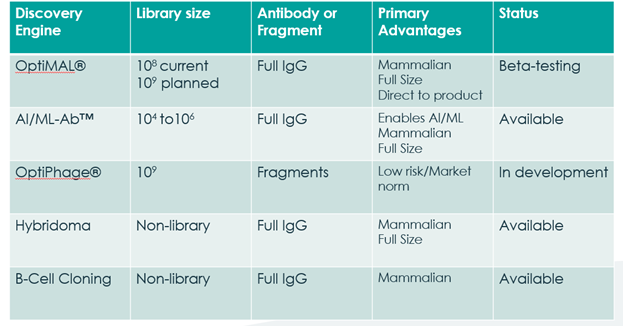

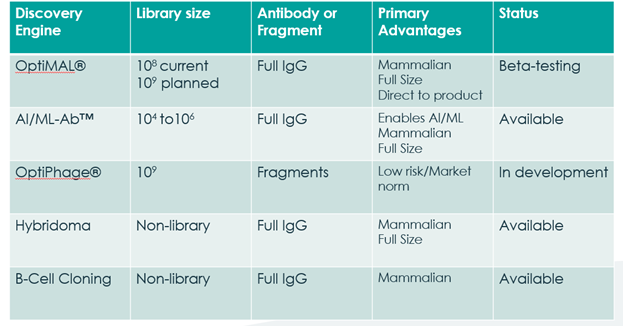

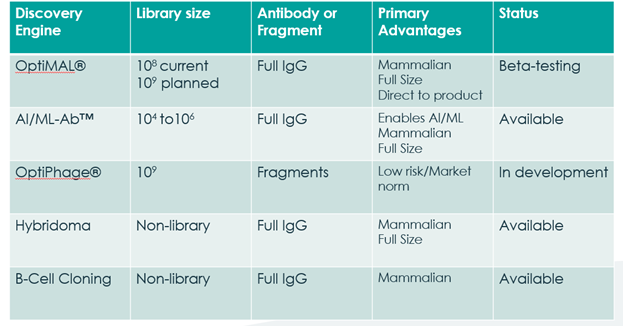

A summary of the antibody “Discovery Engines” available to Fusion and its clients.

At Fusion, our aim is to develop a range of services that gives our clients choice and a range of solutions best suited to the biological needs of their targets and applications. We understand that ‘one size’ does not fit all and have therefore broadened our service menu to give the customer the best chance of meeting their technical objectives with the least risk. We will continue to develop further solutions to enhance the competitive advantages for Fusion and for our clients.

The Company secured additional investment in June 2023, raising just under £1.7 million (before expenses) and a further £1.37 million in March 2024 primarily to fund additional commercial activities addressing the additional market sectors of diagnostics and veterinary medicine. Thanks to the continued support of our shareholders, we can move forward with establishing our presence in these adjacent markets and maintaining investment into our new discovery services.

Business Review

The Company’s revenue in FY24 fell by 61% vs FY23 to £1.14m due to the macroeconomic headwinds. By 30 June 2024, orders had been received amounting to some £0.75m forming the basis for revenue recognisable in FY25 on which we are pleased to have continued to build upon. This is a significant improvement on the position of the prior year and provides positive indications that the business is recovering.

The Directors believe that the addressable market for the Company’s existing ‘Fee for Service’ revenue model is sufficiently large to enable the business to achievable profitability, but that is not the limit to the potential value creation the Company represents. We seek to enter into collaborative agreements which enable Fusion to share in the downstream value of the deliverables of our services and share in their commercial success through milestone payments and royalties. This strategy will further enable the Company to unlock the intrinsic value that our proprietary service platforms provide to our clients and generate additional shareholder value. AI/ML-AbTM, OptiphageTM and OptiMAL® represent key proprietary differentiators and drivers of growth for the business which will enable the Company to access a sizeable addressable market generating significant shareholder value. Furthermore, they underpin our ability to secure value generating milestone and royalty agreements.

The Company ended the year with £1.2m of cash and cash equivalents, having used £2m of cash in operations during the year, invested £0.1m in property, plant and equipment and £0.1m servicing asset-based borrowings. As previously mentioned, in June 2023 and in March 2024 the Company issued equity for combined net proceeds of £2.7m which places Fusion in a good position to continue its sales and marketing activities and progress the development of new discovery platforms and services. Despite FY24 having been a commercially challenging year, the Company took the hard decisions, made the right choices and has survived. As a result, the Company has emerged stronger, more capable and more efficient with better developed proprietary technologies and improved traction in a broader marketplace. We also have some further exciting and enviable technologies in development and are now in a phase of growth from a stronger more stable foundation with three new Discovery Engines: OptiMAL®, OptiphageTM and AI/Ml-AbTM to power our transition toward breakeven and profitability.

During FY24, Fusion was presented with several commercial challenges. Most notably, a significant downturn in venture capital investment into biotechnology companies, including therapeutic antibody development programmes, impacted Fusion’s primary customer type going into the financial year. This directly impacted the Company’s revenues for the financial year.

The Company took steps to meet the challenges presented by the increasing headwinds in the first half of FY24 (“H1”) through a significant restructuring exercise, reducing various costs including a 38% reduction in headcount. Furthermore, a new commercial strategy was implemented, additionally targeting the adjacent Diagnostic, Veterinary Medicine and Research Antibody markets. This diversification has made the sales pipeline more resilient with less exposure to individual sectors.

During H2 FY24, the adverse investment conditions, although improving, continued to impede certain clients placing orders, with some pipeline projects yet to convert and some being received later than anticipated. In several cases this was due to limited availability of client provided materials. This resulted in revenue for H2 FY24 being lower than was anticipated at the time of announcement of the H1 FY24 interim results.

Despite the effects of the headwinds described above, Fusion’s client conversion rate nevertheless improved throughout FY24, with February and March of 2024 being the Company’s highest earning months of FY24. This contributed to revenues in the fourth quarter of FY24 being approximately 47% higher than the first quarter of FY24.

This increase in activity towards the end of the financial year has resulted in a marked increase in the Company’s sales opportunity pipeline. The Company’s order book as at 31 March 2024 was approximately £0.75m, representing approximately 65% of the total FY24 audited revenues.

This increase in activity and the order book provides a foundation for revenue growth in the current financial year (“FY25”).

The Company achieved a number of exciting developments in H2 FY24, including:

- signing a collaboration agreement with the NCI for the use of OptiMAL® in the discovery of novel antibodies against targets selected by NCI post year end;

- securing an estimated $650,000 follow-on project under a collaborative research and development agreement with a US based biotechnology company that Fusion started working with in 2021;

- receipt of a first purchase order under a new MSA with a leading diagnostics company - with further orders having been received under the MSA by the customer subsequently; and

- securing its first OptiPhageTM contract whereby Fusion will design a phage display library using the diversity principles behind the OptiMAL® library.

The Board believes that these developments provide strong evidence that the Company’s diversification strategy, together with the recovering economic climate, provide confidence for growth in FY25.

The Company’s cash balance as at 31 March 2024 was £1.2m, positioning the Company well for the current economic environment.

The 2023 calendar year was very challenging for our clients and therefore also for us. We responded by taking difficult but necessary action whilst also extending our traction with adjacent markets (notably diagnostics, research antibodies and veterinary medicine). As a result, we have secured some excellent new clients, including global leaders in their respective fields, who are now engaging with the Company for multiple projects, several of which are being run in parallel. Achieving this diversification in client base, combined with a recovery in our core human therapeutic sector, provides a very welcomed improvement in market conditions going forward. We remain optimistic for our prospects and look forward to updating the market further. We continue to be thankful to our shareholders for all their support.

Outlook

The economic environment in which the Company is now operating has significantly improved in recent months with revenues now increasing and prospects being converted into orders at a significantly improved rate. We continue to attract clients from around the world including securing initial and follow on work from a new client, the life sciences division of a well-known Japanese conglomerate amongst others. The Company also continues to further exploit its technologies to create additional value: our Mammalian Display platform, which was designed initially for antibodies, has recently been trialled with other proteins. One client found a 10-30 fold increase in yield over there current established production method.

Having made a specific effort to complement the core therapeutics market by targeting adjacent sectors, the push for more diagnostics business is proving fruitful with revenues from this sector currently accounting for around 20% of current year to date earned income.

It remains our goal to reach cash flow breakeven by the second half of calendar year 2025, and as we continue to meet our objectives on that path, we have no plans to raise cash through an equity placement.

Adrian Kinkaid

Chief Executive Officer

4 September 2024

Statement of Profit or Loss and Other Comprehensive Income

For the year ended 31 March 2024

| Note | 2024 | 2023 | ||||

| £’000 | £’000 | |||||

| Revenue | 4 | 1,136 | 2,901 | |||

| Cost of sales | (1,181) | (2,327) | ||||

| Gross profit | (45) | 574 | ||||

| Other operating income | 5 | 11 | ||||

| Administrative expenses | (2,247) | (3,443) | ||||

| Operating loss | 5 | (2,288) | (2,858) | |||

| Finance income | 8 | 3 | 3 | |||

| Finance expense | 8 | (5) | (4) | |||

| Loss before tax | (2,289) | (2,859) | ||||

| Income tax credit | 10 | 63 | 263 | |||

| Loss for the financial year | (2,226) | (2,596) | ||||

| Total comprehensive expense for the year | (2,226) | (2,596) | ||||

| Pence | Pence | |||||

| Loss per share | ||||||

| Basic | 11 | (3.9) | (10.0) | |||

Statement of Financial Position

As at 31 March 2024

| Notes | 2024 £’000 | 2023 £’000 | |||

| Assets | |||||

| Non-current assets | |||||

| Intangible assets | 12 | - | - | ||

| Property, plant and equipment | 13 | 158 | 375 | ||

| 158 | 375 | ||||

| Current assets | |||||

| Inventories | 15 | 460 | 539 | ||

| Trade and other receivables | 16 | 557 | 690 | ||

| Current tax receivable | 46 | 263 | |||

| Cash and cash equivalents | 1,199 | 195 | |||

| 2,262 | 1,687 | ||||

| Total assets | 2,420 | 2,062 | |||

| Liabilities | |||||

| Current liabilities | |||||

| Trade and other payables | 17 | 564 | 844 | ||

| Borrowings | 18 | 20 | 35 | ||

| 584 | 879 | ||||

| Net current assets | 1,678 | 808 | |||

| Non-current liabilities | |||||

| Borrowings | 18 | 23 | 40 | ||

| Provisions for other liabilities and charges | 19 | 20 | 20 | ||

| 43 | 60 | ||||

| Total liabilities | 627 | 939 | |||

| Net assets | 1,793 | 1,123 | |||

| Equity | |||||

| Called up share capital | 21 | 3,815 | 1,040 | ||

| Share premium reserve | 7,743 | 7,647 | |||

| Accumulated losses | (9,765) | (7,564) | |||

| Total equity | 1,793 | 1,123 |

| Simon Douglas | Adrian Kinkaid |

| Director | Director |

Statement of Changes in Equity

For the year ended 31 March 2024

| Notes | Called up share capital £’000 | Share premium reserve £’000 | Accumulated losses £’000 | Total equity £’000 | |

| At 1 April 2022 | 1,040 | 7,647 | (5,003) | 3,684 | |

| Loss and total comprehensive expense for the year | - | - | (2,596) | (2,596) | |

| Share options – value of employee services | - | - | 35 | 35 | |

| Total transactions with owners, recognised directly in equity | - | - | 35 | 35 | |

| At 31 March 2023 | 21 | 1,040 | 7,647 | (7,564) | 1,123 |

| At 1 April 2023 | 1,040 | 7,647 | (7,564) | 1,123 | |

| Loss and total comprehensive expense for the year | - | - | (2,226) | (2,228) | |

| Issue of share capital | 2,775 | 96 | - | 2,871 | |

| Share options – value of employee services | - | - | 25 | 25 | |

| Total transactions with owners, recognised directly in equity | 2,775 | 96 | 25 | 2,896 | |

| At 31 March 2024 | 21 | 3,815 | 7,743 | (9,765) | 1,793 |

Statement of Cash Flows

For the year ended 31 March 2024

| Notes | 2024 £’000 | 2023 £'000 | |

| Cash flows from operating activities | |||

| Loss for the year | (2,226) | (2,596) | |

| Adjustments for: | |||

| Share based payment expense | 86 | 35 | |

| Depreciation | 220 | 372 | |

| Finance income | (3) | (3) | |

| Finance costs | 5 | 4 | |

| Income tax credit | (63) | (263) | |

| Decrease/(Increase) in inventories | 79 | 46 | |

| Decrease/(increase) in trade and other receivables | 133 | 819 | |

| (Decrease)/increase in trade and other payables | (280) | (299) | |

| Cash used in operations | (2,049) | (1,885) | |

| Income tax received | 280 | 131 | |

| Net cash used in operating activities | (1,769) | (1,754) | |

| Cash flows from investing activities | |||

| Purchase of property, plant and equipment | 13 | (2) | (114) |

| Finance income – interest received | 8 | 3 | 3 |

| Net cash used in investing activities | 1 | (111) | |

| Cash flows from financing activities | |||

| Proceeds from new issue of share capital net of transaction costs | 2,808 | - | |

| Proceeds from new borrowings | 18 | - | 69 |

| Repayment of borrowings | 18 | (33) | (62) |

| Finance costs – interest paid | 8 | (5) | (4) |

| Net cash generated/(used in) from financing activities | 2,770 | 3 | |

| Net decrease in cash and cash equivalents | 1,002 | (1,862) | |

| Cash and cash equivalents at the beginning of the year | 195 | 2,049 | |

| Effects of exchange rate changes on cash and cash equivalents | 2 | 8 | |

| Cash and cash equivalents at the end of the year | 1,199 | 195 |

2024

Final Results

05 September 2024

Fusion Antibodies plc (AIM: FAB), specialists in pre-clinical antibody discovery, engineering and supply for both therapeutic drug and diagnostic applications, announces its final results for the year ended 31 March 2024.

DownloadTo view a full version of the results in |

Commercial and operational highlights

- Audited revenues for FY24 of £1.14m (FY23: £2.90m)

- Fundraise announced in February 2024, raising £1.37m (before expenses) for general working capital and investment into commercial activities

- Significant increase in sales pipeline opportunities during the second half of FY24, with an orderbook at 31 March 2024 of £0.75m, representing 65 per cent. of total FY24 audited revenues

- Cash position as at 31 March 2024 of £1.2m (31 March 2023: £0.2m)

Post period end highlights

- Increased activity in the second half of FY24, including:

- the entry into a collaboration agreement with the National Cancer Institute for the use of OptiMAL®;

- a first purchase order received under a master services agreement (“MSA”) with a leading diagnostics company; and

- a follow-on project received with a US based biotechnology client.

Adrian Kinkaid, CEO of Fusion Antibodies commented: “We have had a largely challenging FY24, with the industry experiencing significant headwinds especially in the venture capital funded biotech sector. A number of clients had consequently delayed initiating their projects with us as a result of this. Having said that, we are starting to see an improvement and we did complete a successful fundraise for further investment into the business in February this year.

“Since the year end, we have increased commercial activity and had more success, with a number of new agreements signed. The OptiMAL® programme is continuing to go well, and we are seeing more traction in the field as the year progresses.

“We remain positive about the future of the Company and are, as always, thankful to our dedicated shareholders for their constant support. As we continue to meet our objectives on our strategy toward breakeven and profitability, we have no plans to raise cash through an equity placement.”

Investor briefing

Fusion will host an online live presentation open to all investors on Thursday, 12 September 2024 at 3pm BST, delivered by Dr Adrian Kinkaid, CEO and Stephen Smyth, CFO. The Company is committed to providing an opportunity for all existing and potential investors to hear directly from management on its results whilst additionally providing an update on the business and current trading.

The presentation will be hosted through the digital platform Investor Meet Company.

Investors can sign up to Investor Meet Company for free and add to meet Fusion Antibodies plc via the following link: https://www.investormeetcompany.com/fusion-antibodies-plc/register-investor

For those investors who have already registered and added to meet the Company, they will automatically be invited. Questions can be submitted pre-event via your IMC dashboard or in real time during the presentation, via the "Ask a Question" function. Whilst the Company may not be in a position to answer every question it receives, it will address the most prominent within the confines of information already disclosed to the market through regulatory notifications. A recording of the presentation, a PDF of the slides used, and responses to the Q&A session will be available on the Investor Meet Company platform afterwards.

Enquiries:

| Fusion Antibodies plc | www.fusionantibodies.com | |

| Adrian Kinkaid, Chief Executive Officer Stephen Smyth, Chief Financial Officer | Via Walbrook PR | |

| Fusion Antibodies interactive investor hub | https://investorhub.fusionantibodies.com/ | |

| Allenby Capital Limited | Tel: +44 (0) 20 3328 5656 | |

| James Reeve/Vivek Bhardwaj (Corporate Finance) Tony Quirke/Joscelin Pinnington (Sales and Corporate Broking) | ||

| Shard Capital Partners LLP | ||

| Damon Heath (Joint Broker) | Tel: +44 (0) 207 186 9952 | |

| Walbrook PR | Tel: +44 (0)20 7933 8780 or [email protected] | |

| Anna Dunphy | Mob: +44 (0)7876 741 001 | |

About Fusion Antibodies plc

Fusion is a Belfast based contract research organisation ("CRO") providing a range of antibody engineering services for the development of antibodies for both therapeutic drug and diagnostic applications.

The Company's ordinary shares were admitted to trading on AIM on 18 December 2017. Fusion provides a broad range of services in antibody generation, development, production, characterisation and optimisation. These services include antigen expression, antibody production, purification and sequencing, antibody humanisation using Fusion's proprietary CDRx TM platform and the production of antibody generating stable cell lines to provide material for use in clinical trials. Since 2012, the Company has successfully sequenced and expressed over 250 antibodies and successfully completed over 200 humanisation projects and has an international, blue-chip client base, which has included eight of the top 10 global pharmaceutical companies by revenue.

The Company was established in 2001 as a spin out from Queen's University Belfast. The Company's mission is to enable pharmaceutical and diagnostic companies to develop innovative products in a timely and cost-effective manner for the benefit of the global healthcare industry. Fusion Antibodies provides a broad range of services in antibody generation, development, production, characterisation and optimisation.

Fusion Antibodies growth strategy is based on combining the latest technological advances with cutting edge science to deliver new platforms that will enable Pharma and Biotech companies get to the clinic faster, with the optimal drug candidate and ultimately speed up the drug development process.

The global monoclonal antibody therapeutics market was valued at $186 billion in 2021 and is forecast to surpass $445 billion in 2028, an increase at a CAGR of 13.2 per cent. for the period 2022 to 2028. Approximately 150 monoclonal antibody therapies are approved and marketed globally as of June 2022 with the top four antibody drugs each having sales of more than $3 bn in 2021.

Chairman’s Statement

The financial year ended 31 March 2024 (“FY24”) started the way the previous financial year had ended, in that the markets in which we operate remained muted, and it was commercially challenging for the Company. However, this challenge was met head on by the board of directors of the Company (the “Board” or the “Directors”), and in particular, through determination and a belief that Fusion has world class skills and expertise to create value for our shareholders, the turnaround process began. In FY24, costs were cut, headcount reduced, Board salaries deferred and a new strategy was developed. With venture capital and other investments for our customers’ early-stage human therapeutic pipelines still slow, creative solutions and antibody related new market opportunities were explored. Fusion responded both by introducing our existing services into new markets as well as introducing new services into our current markets.

New markets

Antibodies play an important part in most of our lives at some point. Obviously internally your immune system is there to combat disease and keep you healthy. But antibodies are used in many different healthcare related applications, and Fusion’s skills and expertise are applicable to all of them.

Human antibody therapeutics was our sole focus and will still be the main source of revenue in the near term but expanding into the smaller but growing veterinary medicine (VetMed) therapeutics market is an exciting new opportunity. The 30-year gap between the development of antibodies for humans and those for animals is partly because while some other human medications can be easily adopted to use in animals, antibody therapy is species specific. However, the genetic differences between species is now better understood and, in the same way as we gained a leading position in humanisation, Fusion has the capability for producing dog and cat specific antibodies, through processes known as caninisation and felinisation. There is a growing need for these therapies in veterinary medicine. For example, in the USA alone there are 6 million cases of cancer1 diagnosed each year in dogs, with a similar number in cats, and one in four American dogs is diagnosed with some form of arthritis1. In addition, allergies, dermatological conditions, renal diseases, cardiac diseases, and cancer are five key disease categories for research into new animal specific antibody therapies2.

The global monoclonal antibodies in veterinary health market size was estimated at USD 700m million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.1% from 2023 to 20303. Amongst other developments, in 2016, the USDA3 approved a monoclonal antibody to treat allergic dermatitis and atopic dermatitis in dogs and, in January 2022, the FDA granted its first approval for an antibody for animals to control pain associated with osteoarthritis in cats2.

We believe that this new market represents a strong opportunity in a strongly growing sector where most of our current services, such as OptiPhageTM, Rational Affinity Maturation Platform (“RAMP”), affinity maturation, transient expression and cell line development (“CLD”) are applicable.

1 Antibody Therapeutics - PetMedix

2 Monoclonal antibodies show promise as new therapy for veterinary patients | American Veterinary Medical Association (avma.org)

3 The U.S. Department of Agriculture (USDA) approves antibodies that target the immune system, while the FDA approves antibodies that have other targets in VetMed

4 Monoclonal Antibodies In Veterinary Health Market Report, 2030 (grandviewresearch.com)

At some point in our lives, most of us will have a blood or urine sample that is sent off to a laboratory to be tested and the test will involve antibodies in one form or another. Over the counter pregnancy tests are antibody based and we are now all familiar with the lateral flow tests for Covid-19, with the red coloured lines that appear being antibody driven. With the diagnostic market becoming more competitive, the quality, specificity and reliability of the antibody is key to the success of that test. Diagnostic companies from small to large are starting to look at ways of improving their tests through the manipulation of their antibodies to which the skills that Fusion have developed throughout the years are applicable. In addition to improving the antibody, diagnostic companies are also looking to improve continuity of supply as many of the tests will be based on polyclonal antibodies (antibodies taken directly from blood as opposed to a cell culture) which have a finite supply. While not simple, the possibility to convert these polyclonal antibodies to a secure cell structure-based supply exists, presenting Fusion with a further market opportunity. Additionally, many antibodies used in diagnostics and therapeutics start their life in pure research laboratories and companies that supply these products globally represent a further adjacent market for Fusion to sell into.

The Board of Fusion believe that this diversification strategy into the adjacent markets of VetMed, diagnostics, and research, together with the recovering economic climate, provides us with confidence for growth in the current year and the prospects for the business in the future.

Business performance

The poor global market conditions seen at the end of the financial year ended 31 March 2023 (“FY23”) continued into FY24. FY24 showed a significant downturn in revenue from the previous year at £1.14m (FY23: £2.9m). The headwinds of inflation, higher interest rates, weak global growth and continued global political instability have kept the global markets relatively quiet throughout 2023 resulting in weak market investment conditions for new drug discovery and development programs, particularly in SME’s and small earlier stage companies, which represented our primary customer type during the first half of the financial year and directly impacted the Company’s revenues for the year. Most notably was a significant downturn in venture capital (“VC”) investment into biotechnology companies, including therapeutic antibody development programmes. As an example, in the USA VC Life Healthcare and Life Sciences secured US$15.2 billion in fund closures in 2023, down 52% from a high of US$28.9 billion in 20215.

Recognising the economic challenges at the beginning of the financial year, the Company took decisive action to re-structure the business and significantly cut the cost base and implemented circa. £1.6m in restructuring savings, including a significant reduction in headcount. Although business conditions are improving, the Board will continue to closely monitor the Company’s cost base and seek to identify additional cost savings over time. Alongside the restructuring, a new commercial strategy was implemented, targeting the adjacent antibody-based Diagnostic, Veterinary Medicine and Research Antibody markets, with this diversification opening up more sales opportunities as well as making the sales pipeline more resilient with less exposure to individual sectors.

Whilst controlling costs tightly, we still believe that to maintain our scientific cutting edge and to compete in the global marketplace, we need to stay at the front of technology. We continue to invest in R&D, and particularly the OptiMAL® library project, with investment in R&D of £0.3m for FY24 (FY23: £0.8m). The downturn in revenues, together with the restructuring savings, generated a loss for FY24 of £2.3m (FY23: loss £2.9m). It is worth noting that whilst the Company continues to retain an interest of longer-term future success milestone or royalty payments in many of our client projects, there were no such payments in FY24.

The Board would like to thank our shareholders for their continued support and confidence in the Company and in the growth opportunity in front of us. In particular in supporting us through two rounds of funding in FY24, the first of which was to supply working capital to allow us to re-structure the Company and develop a new more diversified strategy. During H1 FY24, the pipeline grew significantly as we entered into the adjacent markets of Diagnostics, VetMed and research antibodies with the second round supporting the further implementation of the strategy and in particular the expansion of the commercial team.

5 Pitchbook’s Healthcare Fund Performance Update, as reported by Tracy Alper from Marks Sattin.

Specifically, in June 2023 the Company successfully completed a £1.67m (before expenses) fundraise through the placing of new ordinary shares of 4p each in the capital of the Company (“Ordinary Share”) at a price of 5 pence per new Ordinary Share (the "Issue Price"), to provide additional working capital. £1.56 million was raised through a placing, £0.14m through a subscription by certain of the directors of the Company and their closely associated persons (as defined in UK MAR) and £0.11m through a Retail Offer on the REX Platform, which resulted in the issue of a total of 33,438,768 new Ordinary Shares. The Issue Price represented a discount of approximately 84 per cent. to the closing mid-market price of an Ordinary Share on 18 May 2023.

With a new commercial strategy in place, and a strengthened pipeline, the Company successfully raised an additional £1,375,000 (before expenses) in March 2024 through a placing of 34,375,000 new Ordinary shares at a price of 4 pence. In this regard, I would like to thank our shareholders, both new and old, who supported this round, in what was a challenging economic environment. 2024 has so far been one of the quietest years for investment on AIM since 2002 and yet the issue price of the second placing was at only a small discount (~ 5.88%) to the closing mid-market price of an Ordinary Share in the Company on 13 February 2024.

Allenby Capital Limited (“Allenby Capital”) acted as broker in connection with the placing, with Shard Capital Partners LLP acting as sub-placing agent to Allenby Capital and following the placing the Company appointed Shard as joint broker to Fusion. We look forward to continuing to work with both brokers as we continue our recovery journey.

New Services

The antibody drug discovery industry and indeed other markets are gradually moving away from the use of antibodies, something that as a Company we recognise and support. Whilst animals can still be used on occasions, our R&D and new service offerings are very much aligned to the ‘Three Rs’ principle: Replacement, Reduction and Refinement*. This is the one of the competitive edges that we offer utilising our core discovery engines, OptiMAL®, OptiPhageTM, and AI/ML-AbTM. The first two are cell-based systems, while the latter is a method of designing panels of antibodies in-silico, using software algorithms. These discovery engines all work as the beginning of a customer’s journey with Fusion, with the potential to move onto the rest of our services all the way through to CLD, where the final antibody of choice is ready to be transferred externally into the production stage.

* Three Rs principle

- Replacement refers to methods which avoid or replace the use of animals

- Reduction refers to any strategy that will result in fewer animals being used

- Refinement refers to the modification of husbandry or procedures to enhance the welfare of an animal used in science

OptiMAL® is our cell-based mammalian display technology screening library in development for the direct identification of intact fully human antibodies against biomarkers and other targets of interest. It will be very much positioned as a discovery engine for human therapeutic antibodies and when fully optimised should reduce the time required to identify a target specific antibody or panel of antibodies and simplify the process of reaching that goal. The Company signed a collaboration agreement with the National Cancer Institute (“NCI”) for access to OptiMAL® over a two-year period in the discovery of novel antibodies against targets selected by NCI, which is the first time the library has been in external hands for independent validation.

Whereas OptiMAL® expresses whole antibodies, our new OptiPhageTM library is a phage display based version where smaller antibody fragments, the antibody’s specific binding components, are expressed and can be screened, at which point the DNA sequences of these fragments can be used to produce a full antibody for downstream development and further optimisation. It may also be the platform of choice for those wanting antibody fragments as their end-product. As a new service available since March 2024, we believe that the ability to provide OptiPhageTM at a lower price point allows the Company to protect the premium pricing of the OptiMAL® programme and to open it up to other markets who may have greater budgetary constraints. Our novel DNA library of antibody sequences from OptiMAL® can be used as the input design, as can other inputs for non-human applications.

In conjunction with our partners, the AI/ML-AbTM platforms provide a method of designing panels of antibodies in-silico, with the AI/ML-AbTM algorithms typically producing small libraries of sequences which are an excellent match with our Mammalian Display platform, which can transform these designs into real protein molecules for screening and final selection. While customer uptake to date has been slow, we believe that this remains an important part of our broad mix of discovery services that we offer which gives the client the choice to select which one suits them the best from their timescales, development plans and budgets.

Board and Employees

August 2023 saw the appointment of Stephen Smyth as our interim Chief Financial Officer (CFO) and Company Secretary. Stephen has over 25 years’ experience working in audit & accounting, finance, and operations management within both the public accounting and commercial sectors and we are delighted that he could join us. In addition, we have outsourced some other financial management accounting activities enabling the Company to streamline its financial position, following which the Company intends to identify a more permanent solution.

Prior to this we announced that Mr James Fair, our former CFO, was stepping down from the Board and that we would like to thank Mr James Fair for his significant contribution to the Company over the past 14 years and wish him well in his future endeavours. We are also grateful to Ms Frances Johnston who temporarily stepped in as the Company Secretary until Stephen Smyth’s appointment.

One further change to the Board during the financial year was in relation to Sonya Ferguson, who stepped down in September 2023 as a Non-executive Director to move into another business opportunity. Sonya was with the Company for seven years and was the Chair of the Company’s Remuneration Committee. On behalf of the Board, I would like to thank her for all that she had done for the Company, for her valuable insights and contributions and her balanced views. We wish her well in her new venture.

During the first half of FY24, the Executive team had to make some decisive and tough decisions as part of the restructuring process, something for which the Board is very grateful. In this respect, a big thank you to all the staff who stuck with us through the turbulent times and worked in the difficult transitionary environment with professionalism and integrity and their strength and belief in the Company has allowed us to ride the storm and to turn the Company around. With a significantly reduced headcount, staff have received extensive cross training to ensure that the Company can still offer its full range of services. A true team effort.

As part of their commitment and belief in the Company, in order to minimise the outgoing costs until the Company had secured the funds from the second fundraise in March 2024, the executive directors, Adrian Kinkaid and Richard Buick, deferred 20% of their salary and then only took half as salary with the remainder in new Ordinary Shares at the issue price of 4 pence. Likewise, the Company’s non-executive directors deferred their fees for 10 months and were subsequently remunerated part in salary and part in new Ordinary Shares, a structure that will continue until the end of FY25.

Corporate governance

The long-term success of the business and delivery on strategy depends on good corporate governance. The Company complies with the Quoted Companies Alliance Corporate Governance Code as explained more fully in the Governance Report.

Post year end and outlook

As reported, the full year results for FY24 are lower than anticipated, but the restructuring, fundraising and market diversification strategy has given the Company a new foundation on which to grow. Trading has improved throughout the year with February and March 2024 being the Company’s highest earning months of FY24. There has been a significant increase in sales pipeline opportunities, which are now around three times greater than they were at the beginning of the financial year, and include new Diagnostic, VetMed and Research potential customers. In addition to the increased sale pipeline our R&D OptiMAL® library project hit a major milestone in H2 FY24 and signed a collaboration agreement with the NCI for the use of OptiMAL® in the discovery of novel antibodies against targets selected by NCI post year.

There was an increased commercial activity and momentum in the fourth quarter of FY24 and into the beginning of FY25, including:

- receipt of a first purchase order under a master services agreement (“MSA”) with a leading diagnostics company in FY24 - with further orders having been received in FY25 under the MSA from the customer;

- securing an estimated $650,000 follow-on project under a collaborative research and development agreement with a US based biotechnology company that Fusion started working with in 2021; and

- A commercial contract to develop a bespoke OptiPhageTM library for a non-human antibody species with a leading global provider of antibodies for use in research and diagnostics.

In July 2024, we announced that our unaudited revenues for the first quarter (“Q1”) of FY25 was c. £522k (Q1 FY24: £241k and FY24: £1.14m) with a strong sales pipeline. The order book includes a number of multi-stage projects for its clients and, subject to these projects progressing in line with expectations, revenue is expected to be recognised for all projects in the current order book in the current financial year.

The Company continues to carefully control its cash and, as set out at the time of the fundraise in February 2024. Based on updated internal estimates the Company now has a cash runway into the second half of FY26. The Company continues to seek to achieve cash neutrality during that timeframe.

The Board of Fusion believe that this momentum and developments provide strong evidence that the Company’s diversification strategy, together with the recovering economic climate, provide confidence for growth in FY25.

Simon Douglas

Chairman

4 September 2024

CEO’s report and operations review

Fusion emerges from a difficult and challenging FY24 as a much improved, more capable and more efficient business with great prospects for growth in revenues and value creation courtesy of our proprietary technologies.

During FY24, the Company was presented with several commercial and financial challenges which we met robustly and with determination. Most notable was a continued downturn in the global market. Through 2023, many of our clients experienced challenges in securing investment to support their research and development activities. This was especially so for the smaller biotechnology companies reliant on venture capital funding for novel therapeutic discovery projects. This represented a significant proportion of our pre-existing client base and, with their delayed plans for early-stage development projects had significant knock-on effects on revenues for the Company. Remedial action was speedily taken and effectively realised. A defined programme of cost saving measures was put in place at the start of FY24 which included significant restructuring, reducing various costs including a 38% reduction in headcount. At the same time, plans to extend and diversify the client base were implemented to address the adjacent and substantial Diagnostic, Veterinary Medicine and Research Antibody markets. The positioning of the Company’s offerings were adjusted to improve efficiency and have more impact with this diversification making the sales pipeline more resilient with less exposure to individual sectors and increasing the overall addressable market size.

In particular, we increased our efforts in targeting the diagnostics industry, which has been enjoying an unprecedented level of awareness especially through the Covid-19 related antibody enabled lateral flow devices and related cash inflows. In the latter part of the year this resulted in several contract wins for Fusion with both small and large diagnostics organizations, the latter exemplified by the Master Service Agreement announced on 14th February 2024. The process of discovering and developing antibodies for diagnostics applications is very similar to that for therapeutics and fits well with our preferred business model whereby we can take responsibility for the process from as early as antigen design for the nominated target through to supply of antibodies. As previously stated for therapeutics, this fully integrated approach allows us to derive more revenue per project by assuming more responsibility for more of the research programme. It also positions the business to better exploit our emerging platforms for antibody discovery, our “Discovery Engines”, which we continue to develop making best use of the different component technologies from the OptiMAL® research project.

Similarly for the Veterinary Medicine market, which has an estimated global value of $46.5bn and a forecasted compound annual growth rate of 8.3% from 2024 to 2030 [Veterinary Medicine Market Size, Share, Growth Report 2030 (grandviewresearch.com)], the Company identified several potential partners and projects. The requirement for making antibodies suitable for use in companion animals such as dogs and cats known as caninisation and felinisation respectively is very similar in nature to the humanisation processes for which Fusion is an established world leader. The Company is therefore continuing to exploit this growth market and increasing its sales and marketing efforts in the area building awareness with this specialist client base.

The initial objective for the research project was to create OptiMAL®, a groundbreaking and industry leading platform for the discovery of human antibodies through a highly diverse library of DNA sequences expressed as fully intact antibodies, or IgG molecules, expressed on the surface of mammalian cells. This has now been largely achieved and whilst in beta-testing stage we were delighted to announce in November 2023, a 2-year agreement with the NCI, part of the National Institutes of Health in the USA, to validate OptiMAL® screening against a small number of targets in the NCI’s own laboratories. This will validate not only the technology but also the ability to transfer it to other organizations and so lay the path for potential licensing agreements with, for example, big pharma and major biotechnology companies. Furthermore, the significant prestige and kudos associated with NCI make them an ideal partner for this process and an organization with which we seek to strengthen our connections.

Two further discovery platforms: OptiphageTM and AI/ML-AbTM have also been launched off the back of the OptiMAL® research programme. OptiphageTM utilises a library based on the same principles as OptiMAL®, but in a more industry standard phage-display format, whilst the Mammalian Display element of OptiMAL® can be combined with algorithms for the de novo design of novel antibodies from various artificial intelligence (AI) and Machine Learning (ML) technologies which continue to generate interest and excitement in the field. We were very pleased to launch AI/ML-AbTM in August 2023 with an almost immediate contract win. OptiphageTM also attracted significant client attention even before launching in April 2024. This was achieved through a contract with an early adopter seeking a non-animal-based solution to generating non-human antibodies primarily for research and diagnostic applications as announced on 15th April 2024. The availability of these diverse and complementary proprietary “Discovery Engines”, which can be deployed individually or in concert, also enables us to provide a de-risked approach to antibody discovery further benefiting our clients and strengthening Fusion’s position as the partner of choice.

A summary of the antibody “Discovery Engines” available to Fusion and its clients.

At Fusion, our aim is to develop a range of services that gives our clients choice and a range of solutions best suited to the biological needs of their targets and applications. We understand that ‘one size’ does not fit all and have therefore broadened our service menu to give the customer the best chance of meeting their technical objectives with the least risk. We will continue to develop further solutions to enhance the competitive advantages for Fusion and for our clients.

The Company secured additional investment in June 2023, raising just under £1.7 million (before expenses) and a further £1.37 million in March 2024 primarily to fund additional commercial activities addressing the additional market sectors of diagnostics and veterinary medicine. Thanks to the continued support of our shareholders, we can move forward with establishing our presence in these adjacent markets and maintaining investment into our new discovery services.

Business Review

The Company’s revenue in FY24 fell by 61% vs FY23 to £1.14m due to the macroeconomic headwinds. By 30 June 2024, orders had been received amounting to some £0.75m forming the basis for revenue recognisable in FY25 on which we are pleased to have continued to build upon. This is a significant improvement on the position of the prior year and provides positive indications that the business is recovering.

The Directors believe that the addressable market for the Company’s existing ‘Fee for Service’ revenue model is sufficiently large to enable the business to achievable profitability, but that is not the limit to the potential value creation the Company represents. We seek to enter into collaborative agreements which enable Fusion to share in the downstream value of the deliverables of our services and share in their commercial success through milestone payments and royalties. This strategy will further enable the Company to unlock the intrinsic value that our proprietary service platforms provide to our clients and generate additional shareholder value. AI/ML-AbTM, OptiphageTM and OptiMAL® represent key proprietary differentiators and drivers of growth for the business which will enable the Company to access a sizeable addressable market generating significant shareholder value. Furthermore, they underpin our ability to secure value generating milestone and royalty agreements.